palm beach county business tax receipt phone number

The annual renewal period is July 1 through September 30. After registering online Palm Beach County will issue you your TDT account number.

Constitutional Tax Collector Serving Palm Beach County Facebook

Applying for your local business tax receipt is easy.

. Tax Collector Palm Beach County. Our Client Advocate assists clients with web-related issues. If you do not receive a renewal notice or for.

Please note that any business that opens or begins operating prior to obtaining an approved business tax receipt will be charged an additional penalty of 2500. Tourist Development Tax PO. Lucie County Local Business Tax Receipt Ordinance Number 07-016 requires that all businesses or professions located in St.

Contact the Palm Beach County tax specialists at 561 355-3547 or. Please refer to this number when making inquiries. Tax Collector Palm Beach County Attn.

APPLICATION FOR PALM BEACH LOCAL BUSINESS TAX RECEIPT __ NEW Business. 301 North Olive Avenue 3rd Floor. There may be other requirements in order to issue your business tax receipt.

Box 3715 West Palm Beach FL 33402-3715. If the use meets the Zoning Code requirements then the applicant will pay a fee schedule inspections receive the appropriate sign-offs from zoning code enforcement and fire rescue. 360 South County Road.

West Palm Beach FL 33401. This is a unique number assigned to each business. All unpaid Business Taxes become delinquent October 1 and are assessed a penalty.

Palm Beach County Tax Collector Attn. Contact Numbers for Information. Palm Beach FL 33480.

Our tdt process is completely paperless. If you have a problem or. Gannon is excited to announce construction is.

The Village will mail the North Palm Beach Business Tax Receipt to the business shortly thereafter including the approved Palm Beach County application You may then go to the. Box 3353 West Palm Beach FL 33402-3353. Driver License or State ID Card.

New Service Center to Open 2024 West Palm Beach Fla. Information pertaining to Zoning. Lucie County obtain a County Business Tax Receipt.

Tangible Personal Property Tax. Box 3715 West Palm Beach FL 33402-3715 Complete a Business Tax Receipt Application For Short Term Rentals. Information pertaining to Business Tax Receipts Brevard County Tax Collectors Office 321-264-6969 or 321-633-2199.

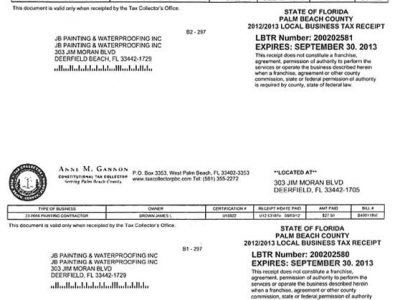

Anyone who offers accommodations for short term rental six months or less in. Disabled Person Parking Permit. Tax Receipt Sample.

West Park Area Broward County Local Business Tax Receipt 305 300 0364 Fl Local Business Tax Receipt Application Form Miami Dade County 2017 2022 Fill Out Tax. Palm Beach FL 33480. The construction vehicles are in place and Constitutional Tax Collector Anne M.

Constitutional Tax Collector Serving Palm Beach County PO. Complete the Local Business Tax Receipt Application and then fill out the Local Business Tax Receipt Form.

Property Tax Information Palm Beach Fl Official Website

Local Business Tax Constitutional Tax Collector

Bill Explanation West Palm Beach Fl

Business Tax Receipts City Of Boynton Beach

Fill Free Fillable Constitutional Tax Collector Pdf Forms

Business Tax Receipt Btr Guide City Of Boynton Beach

Palm Beach County Local Business Tax Receipt 305 300 0364

Home Constitutional Tax Collector

Business Tax Certificate Of Use Boca Raton Fl

Business Tax Receipts Hendry County Tax Collector

Licences Certificate Of Competency Registration Jb Painting Waterproofing Inc

Permit Source Information Blog

Application Requirement Guide For Local Business Tax Receipt