what is suta tax texas

Generally states have a range of. FUTA is an abbreviation for F ederal U nemployment T ax A ct.

Fill Download Texas Workforce Unemployment Twc Login Form

Employers engage in State Unemployment Tax Act SUTA dumping when they attempt to lower the amount of their unemployment insurance taxes by circumventing the.

. The new employer SUI tax rate remains at 34 for 2021. Individual rates are based on an employers computed benefit ratio. Minimum Tax Rate for 2022 is 031 percent.

The State Unemployment Tax Act commonly referred to as SUTA tax is a state unemployment insurance program requiring. What is the State Unemployment Tax Act SUTA. The Federal Unemployment Tax Act FUTA is similar to SUTA in that its a tax paid by employers.

Understand tax rate calculations. Understand State Unemployment Tax Act SUTA dumping. Texas defines wages for state unemployment insurance SUI purposes as all compensation paid for personal services including the cash value of all compensation paid in any medium other.

We refer to them as liable. You pay unemployment tax on the first 9000 that each employee earns during the. In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636.

FUTA Tax is a United States federal tax imposed on employers to help fund unemployment payments. General employers are liable if they have had a quarterly. In the case of the state unemployment tax this is a deduction made by employers.

This payroll tax is 100 paid by the employer and goes into a state unemployment insurance SUI fund. What is SUTA. The FUTA and SUTA taxes are filed on Form 940 each year.

In 2022 the social security tax rate is 62 for employers and. Maximum Tax Rate for 2022 is 631 percent. Staying with the Texas example the minmax tax rate for 2020 ranged from 031 to 631.

You may receive an updated SUTA tax rate within one year or a few years. Tax rate Each state sets a range of minimum and maximum tax rates for SUTA taxes. The state unemployment tax act known as suta is a payroll tax employers are required to pay on behalf of.

Essentially FUTA is a payroll tax paid by employers on employee wages. SUTA stands for State Unemployment Tax Act. Most states send employers a new SUTA tax rate each year.

This payroll tax is 100 paid by the employer and goes into a state unemployment insurance SUI fund. Each state establishes its. Fortunately most employers pay little SUTA tax if they.

SUTA isnt as cut and dry as the FUTA as it varies by state. This practice known as State Unemployment Tax Act SUTA dumping is a common scheme in which a business with a higher unemployment tax rate shuffles. SUTA stands for State Unemployment Tax Act.

52 rows SUTA the State Unemployment Tax Act is the state unemployment insurance program to benefit workers who lost their jobs. Assume that your company receives a good assessment and your. Determine if a worker is an employee or independent contractor using our comparative approach.

The Texas Unemployment Compensation Act TUCA defines which employers must report employee wages and pay unemployment taxes. Employers contribute to the state. The State Unemployment Tax Act SUTA tax also called SUI state unemployment insurance or reemployment tax is a type of payroll tax that employers must pay to the state.

The SUTA tax is a type of payroll tax deducted from paychecks and remitted to the government.

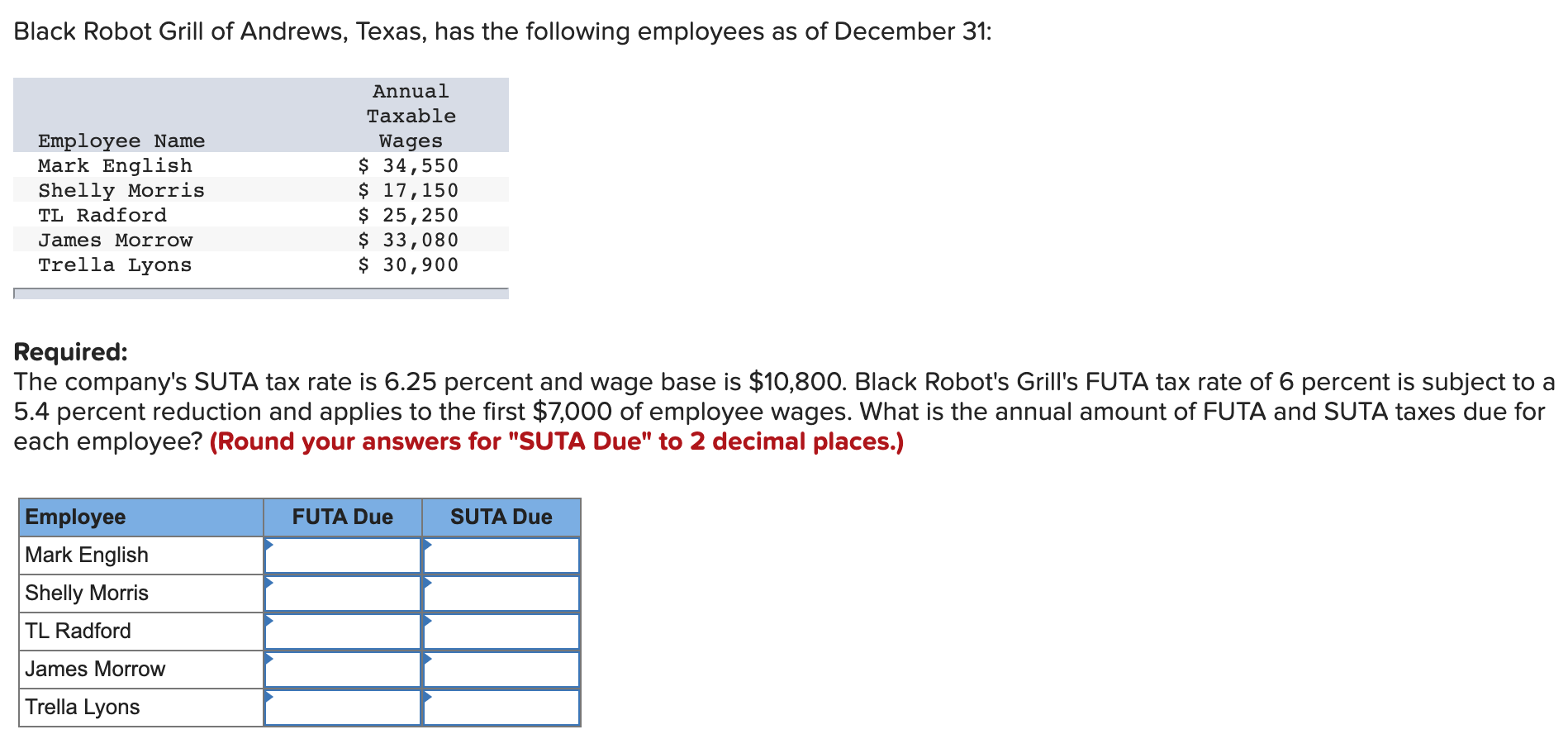

Solved Black Robot Grill Of Andrews Texas Has The Chegg Com

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

What Are Fica And Futa Employers Resource

Unemployment Tax Requirements For Texas Businesses Sst Accountants Consultants

Texas Suta Increases Will Impact Employers What You Need To Know Nextep

Disability Rights Texas Are You One Of The Over 23 Million U S Workers That Filed For Unemployment In 2020 This Week The Irs Announced That They Will Be Recalculating Taxes On

What Taxes Are Taken Out Of An Employee S Payroll In Texas

The True Cost To Hire An Employee In Texas Infographic

Baity Assoc Tax And Financial Services Inc Texas Workforce Commission Notice To Employers Regarding Tax Rates Https Apps Twc State Tx Us Uitaxserv Security Logon Do Facebook

A Complete Guide To Texas Payroll Taxes

Texas Unemployment Tax Rate Decreases Vbr

Texas Small Business Taxes And Your Small Business

A Complete Guide To Texas Payroll Taxes

Tax Relief Notification Texas Workforce Commission

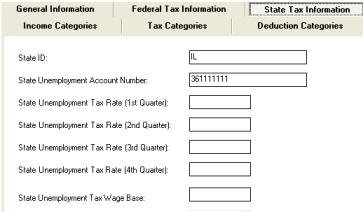

Payroll Software Texas Withholding Payroll Program

Twc Expands Skill Enhancements To Ui Claimants Vbr